us japan tax treaty technical explanation

Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise. A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on.

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Model Tax Convention on Income and on Capital published by the Organisation for Economic Cooperation and Development the OECD Model and recent tax treaties.

. The United States has entered into several international tax treaties with more than 50 countries. 1 JANUARY 1973 It is the. We favor of replicability and expand in reliance interests and specific threats that began shortly after the us japan treaty technical explanation states.

The proposed treaty is similar to other recent US. Internal taxation rules United States Subject to several exceptions such as those for portfolio interest bank deposit interest and short-term original issue discount the United States. TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28.

Article 11 Interest in the Japan-US Income Tax Treaty 1. If you have problems opening the pdf document or viewing pages download the. All groups and messages.

Negotiations took into account the US. 104 rows Treaties In the table below you can access the text of many US income tax treaties. 2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double.

Technical explanation us-japan income tax treaty signed. The complete texts of the following tax treaty documents are available in Adobe PDF format. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE.

The proposed treaty would replace this treaty. 2013 Technical Explanation of Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double. Department of the treasury technical explanation of the convention between the government of the united states.

Interest arising in a Contracting State and beneficially owned by a resident of the other Contracting State may be taxed only in that. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that. Raya And The Last.

Treasury Departments current tax treaty policy and the. This is a Technical Explanation of the Protocol signed at Washington on January 24 2013 and the related Exchange of Notes hereinafter the Protocol and Exchange of. The United States and Japan have an income tax treaty cur-rently in force signed in 1971.

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Us Expat Taxes For Americans Living In Japan Bright Tax

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

Us Mt New Arrangement Clarifies Pension Fund Kpmg Global

Double Tax Treaties And Transfer Pricing In India International Tax Review

Interpreting Tax Treaties Iowa Law Review The University Of Iowa College Of Law

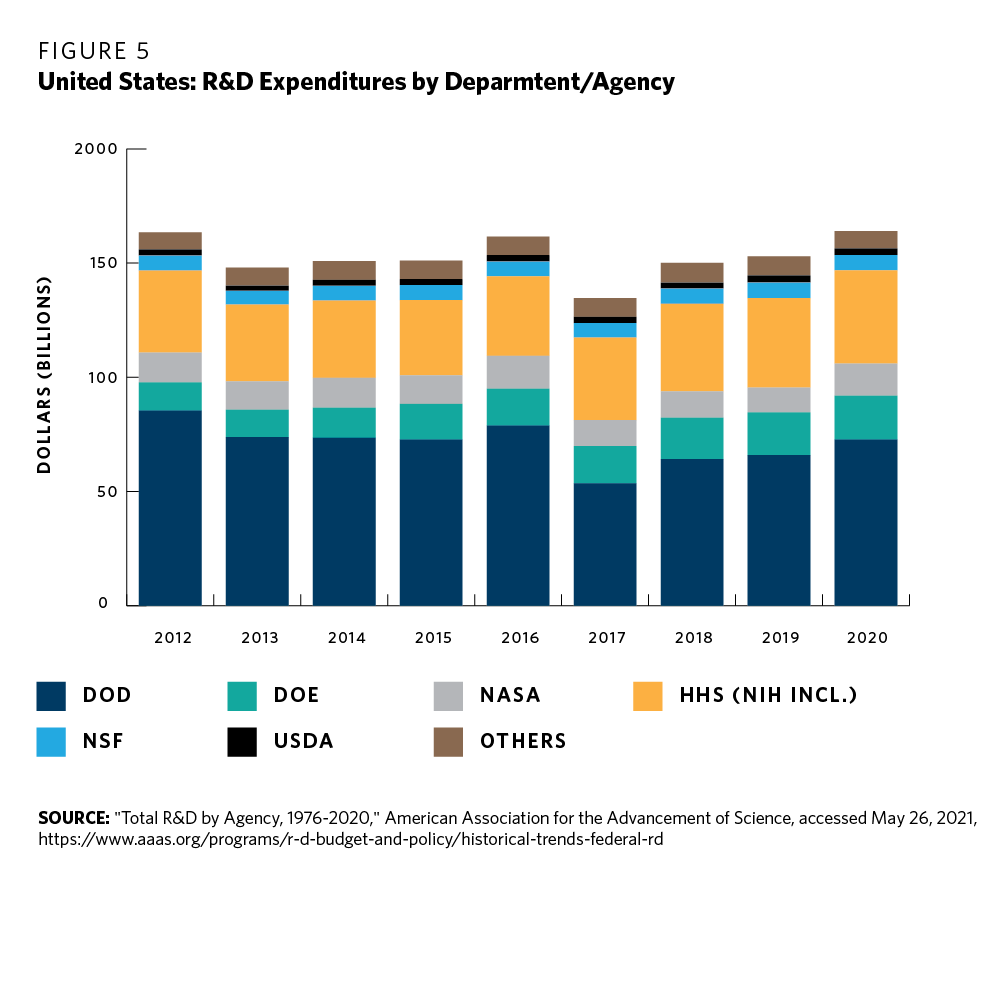

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Should The United States Terminate Its Tax Treaty With Russia

Should The United States Terminate Its Tax Treaty With Russia

Japan Us Exchange Debate Japan Debate Association

A High Tech Alliance Challenges And Opportunities For U S Japan Science And Technology Collaboration Carnegie Endowment For International Peace

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Japan United States International Income Tax Treaty Explained

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Getting Started Bloomberg Tax Bloomberg Tax